Yield farming is a relatively new concept in the world of web3 and decentralized finance (DeFi), but it’s quickly becoming one of the hottest trends in the crypto world.

If you’re new to the scene, you might be wondering what yield farming is and how it works. In this article, we’ll provide a simple and easy-to-follow guide to help you understand yield farming in web3.

What is Yield Farming?

At its core, yield farming is a way to earn returns on your crypto investments. It differs from traditional investments in that it utilizes the unique features of web3 technology, such as smart contracts, to automate the process and remove the middleman, providing higher returns.

In yield farming, you deposit your crypto assets into a pool, which are then used to earn rewards through various activities, such as providing liquidity to decentralized exchanges (DEXs) or staking tokens.

How does Yield Farming work in Web3?

Yield farming in web3 operates using smart contracts, which are self-executing code that run on a blockchain network. These contracts automate the process of yield farming and ensure that all parties follow the agreed-upon rules.

In web3, yield farming is facilitated by decentralized finance (DeFi) platforms, which offer a variety of financial services, including lending, borrowing, and trading.

By providing liquidity to these platforms, you can earn rewards in the form of interest or tokens.

Risks and Rewards of Yield Farming

Like any investment, yield farming comes with both potential rewards and risks. On the positive side, yield farming can offer high returns and provide a way to earn passive income.

On the negative side, there are several risks to consider, such as price volatility, liquidity risks, and smart contract vulnerabilities. It’s important to do your research and understand the risks involved before investing in yield farming.

Yield Farming in Practice

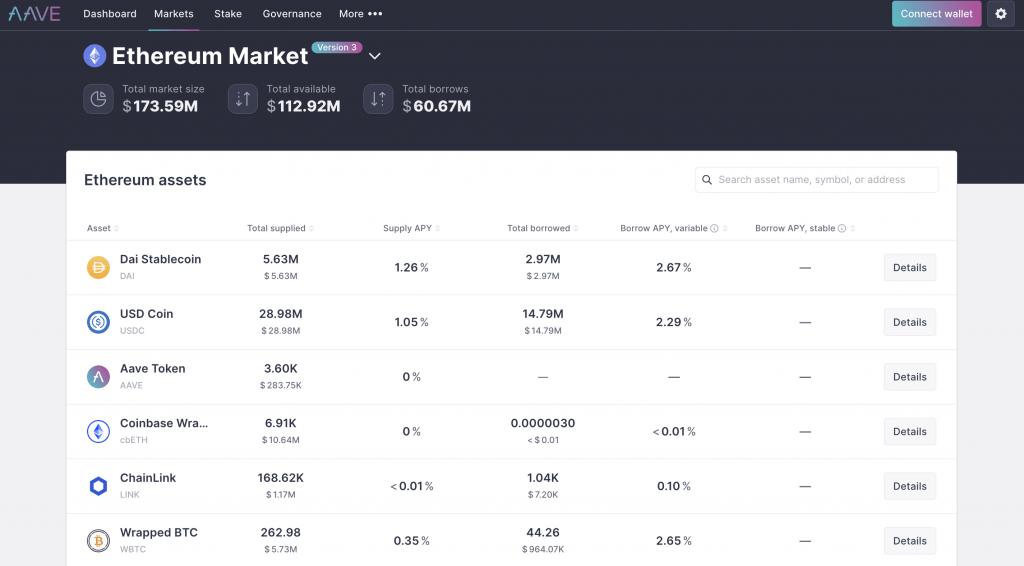

There are many DeFi protocols that offer yield farming opportunities, with some of the most popular being Aave, Compound, and Yearn Finance.

The yields offered by these protocols can vary depending on several factors, such as the token’s liquidity, the length of the deposit, and the level of risk. For example, some protocols might offer higher yields for longer-term deposits, while others might offer lower yields but with less risk.

Summary

Yield farming in web3 is a new and exciting way to earn returns on your crypto investments, but it’s important to understand the risks involved.

By utilizing the unique features of web3 technology, such as smart contracts, yield farming offers a more efficient and automated way to earn rewards.

If you’re interested in yield farming, we encourage you to do your own research and understand the risks involved before investing.

Additional Resources

For more information on yield farming and the DeFi ecosystem, be sure to check out the following resources:

- DeFi Pulse

- DeFi Alliance

- DeFi Llama

We hope this article has helped you understand yield farming in web3.

Happy farming!