Welcome to the future of real estate! Imagine owning a slice of that swanky downtown apartment or a piece of a bustling commercial center.

Sounds like a millionaire’s game, right? Wrong.

Thanks to the magic of Web3 and real estate tokenization, the property market is now more accessible than ever.

Read on as we unveil the top 10 platforms that are making this dream a reality for investors like you.

The Top 10 Real Estate Tokenization Platforms

These are the game-changers, the disruptors, the platforms that are redefining what it means to invest in property.

Whether you’re a seasoned investor or just getting your feet wet, here’s our curated list of the top 10 real estate tokenization platforms you can use today.

Let’s dive in!

1. RealT: The Pioneer in Real Estate Tokenization

RealT has been a game-changer in the real estate tokenization market.

With over 20,000 properties tokenized and a user base that spans the globe, this platform is more than just a buzzword; it’s a revolution.

But what exactly makes RealT the go-to platform for so many investors?

Let’s dive into our in-depth review to find out.

RealT

RealTPros and Cons

| Pros | Cons |

|---|---|

| Easy to use | Fees higher than some competitors |

| Diverse property options | Limited options for non-U.S. residents |

| Strong regulatory compliance | No mobile app, desktop only |

| Secondary market for liquidity |

Features

User-Friendly Interface

Navigating RealT is as easy as scrolling through your social media feed. With intuitive menus and a clean layout, the platform eliminates the intimidation factor that often comes with investment platforms.

Whether you’re a seasoned investor or a complete newbie, you’ll find what you’re looking for in no time.

Diverse Property Options

RealT offers a smorgasbord of property types, from residential homes in the suburbs to bustling commercial centers in the heart of the city.

This diversity allows you to build a well-rounded portfolio without having to juggle multiple platforms.

Whether you’re into urban lofts or rural retreats, RealT has something for everyone.

Secondary Market

One of RealT’s standout features is its secondary market, where you can buy and sell tokens with ease.

Unlike traditional real estate, where selling a property can take months, RealT’s secondary market offers a level of liquidity that’s a breath of fresh air in the property investment landscape.

Regulatory Compliance

RealT isn’t just about making quick bucks; it’s about creating a secure investment environment.

The platform adheres to U.S. securities laws and is compliant with the ERC-20 standard, providing an extra layer of security to your investments.

Customer Feedback

RealT has received rave reviews from its user community. “The platform’s ease of use is unlike anything I’ve seen,” says one user. However, it’s not all sunshine and rainbows.

Some users have pointed out that the fees can be on the higher side. In response, RealT has been transparent about its fee structure and is actively working on offering more competitive rates.

2. Lofty AI

Meet Lofty AI, the platform that’s turning heads and opening wallets.

But before you jump in, let’s dissect the hype and see if it’s worth your time and money.

LoftyAI

LoftyAIPros and Cons

| Pros | Cons |

|---|---|

| Easy to Start | Not a Registered Advisor |

| Daily Rent | Investment Risks |

| No Lock-Up Periods | No Guaranteed Returns |

| Fractional Ownership | Uncertain Property Value |

| User-Friendly Platform | Limited Information Disclosure |

| Liquidity | Regulatory Uncertainty |

Features of the Platform

Fractional Ownership

Own a slice of the American Dream without breaking the bank.

Lofty AI offers fractional ownership, allowing you to invest in properties for as little as $50.

This low entry barrier makes real estate investment accessible to almost anyone.

Daily Rent Payments

Why wait for monthly rent checks when you can get paid daily? Lofty AI’s daily rent feature ensures a steady cash flow, making your investment feel more like a daily dividend.

No Lock-Up Periods

Investment freedom at its finest. Lofty AI lets you liquidate your shares whenever you want, offering a level of liquidity rarely seen in the real estate sector.

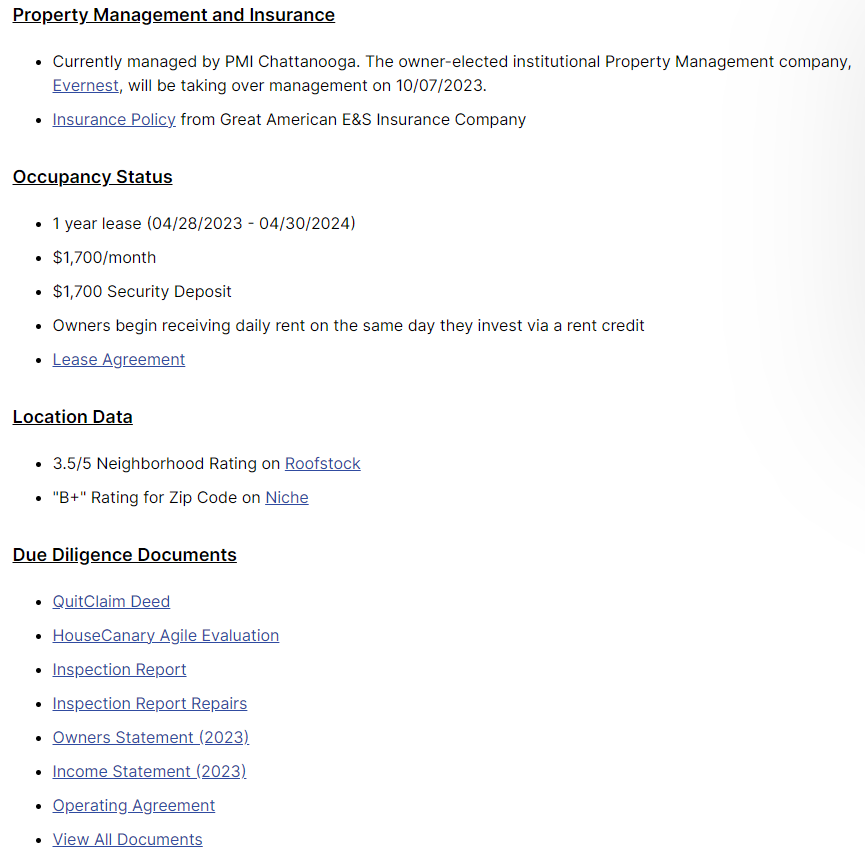

Property-Specific Investment

Lofty AI provides detailed information on specific properties, giving users a variety of documents to look over before making their investment into the property.

Also, it provides a detailed breakdown of each property including the occupancy, location and vital information that any investor needs to make an informed decision.

User-Friendly Interface

The platform is designed for ease of use, ensuring that even those new to real estate investment can navigate the platform effortlessly.

3. HoneyBricks: The Sweet Spot for Multifamily Real Estate Investing?

Ready to dip your toes into the real estate pool but don’t know where to start?

HoneyBricks claims to be the nectar of the real estate gods, simplifying multifamily real estate investing.

But does it deliver the sweet returns it promises, or is it just another buzzword in the investment hive?

Let’s find out.

Honeybricks

Honeybricks

Pros and Cons

| Pros | Cons |

|---|---|

| No Property Management | U.S. Citizenship Required |

| Lower Investment Minimums | Limited Investment Types |

| Monthly Cash Flow | Fee Transparency Unclear |

| Pre-Vetted Investments | |

| High Investor Rating |

Features of the Platform

Passive Income: Sit Back and Relax

HoneyBricks isn’t just about investing; it’s about earning without lifting a finger.

The platform takes the hassle out of property management, so you can focus on what really matters—enjoying your passive income.

Lower Minimums: No Fortune Required

Think real estate is for the wealthy? Think again. With HoneyBricks, you can start your investment journey with as little as $5,000.

It’s democratizing real estate investment, one small step at a time.

Pre-Vetted Investments: No Guesswork

If you’re worried about risky investments, HoneyBricks has got you covered.

The platform offers a marketplace of selected and rigorously pre-vetted investments, taking the guesswork out of your investment choices.

Smart Technology: Investing Made Easy

Gone are the days of cumbersome paperwork and endless waiting. HoneyBricks employs cutting-edge technology to make your investment process as easy as a Sunday morning.

Professional Management: You’re in Good Hands

Don’t know the first thing about real estate management? No worries. HoneyBricks partners with leading real estate managers across the U.S., ensuring your investment is professionally managed.

Customer Feedback

“A lot easier to use than I expected. Good way to diversify my investments!” – Henry Hill

“Fantastic experience – Honeybricks takes a cutting edge (complex) topic of tokenized real estate and makes it simple. Andy and co found a way to code legal compliance for multi-million dollar investments.” – Steven Pack

“Great and easy way to get exposure to real estate.” – Will Bannon

Why You Should Use This Platform

If you’re looking for a simplified, hands-off approach to multifamily real estate investing, HoneyBricks is a compelling option. With its focus on passive income, lower investment minimums, and pre-vetted opportunities, it’s hard not to be tempted.

However, let’s not ignore the bees in the bonnet. The platform is limited to U.S. citizens or residents, and it specializes only in multifamily real estate. Additionally, the fee structure isn’t explicitly laid out, so be sure to comb through the fine print.

So, is HoneyBricks the sweet investment deal it promises to be? That’s the million-dollar question. Are you ready to find your answer?

4. Arrived

Arrived claims to be the game-changer, making real estate investing as easy as online shopping.

But does it live up to the hype, or is it just another pit stop on your investment journey?

Let’s find out.

Arrived

ArrivedPros and Cons

| Pros | Cons |

|---|---|

| Low Investment Minimums | Limited Property Selection |

| Quarterly Dividends | No Direct Property Management |

| Property Appreciation | Unclear Fee Structure |

| Diversification | U.S. Focused |

| Hassle-Free Investment |

Features of the Platform

Low Investment Minimums: Start Small, Dream Big

Who says you need to be a millionaire to invest in real estate? Arrived opens the door with a minimum investment of just $100.

This low entry point democratizes real estate investment, making it accessible to students, young professionals, and anyone who’s ever thought real estate was out of their reach.

Quarterly Dividends: Your Pocket Will Thank You

Imagine getting a paycheck every three months just for investing wisely. That’s what Arrived offers with its quarterly dividends.

It’s like having a mini-bonus four times a year, which you can either reinvest or spend as you please.

It’s a consistent income stream that complements your other earnings.

Property Appreciation: More Than Just Rent Money

Earning rent is great, but what if your property also grows in value over time? Arrived selects properties with high potential for appreciation.

This means that not only do you earn from the rent, but you also stand to gain from the increasing value of your property. It’s a win-win!

Diversification: A Safety Net for Your Portfolio

If you’ve ever felt the jitters from the stock market’s ups and downs, you’ll appreciate the stability that real estate can bring.

Arrived allows you to diversify your investment portfolio by adding real estate to the mix.

This can act as a safety net, balancing out the volatility of other investments like stocks or cryptocurrencies.

Hassle-Free Investment: Investing Without the Headaches

The thought of dealing with tenants, maintenance issues, and legal paperwork can be daunting. Arrived eliminates these headaches by managing the properties for you.

All you need to do is invest, and Arrived takes care of the rest, from tenant management to property upkeep.

Why You Should Use This Platform: The Final Word

If you’re looking to dip your toes into the real estate market without the hassle of property management, Arrived could be your next investment destination.

With its low minimum investment, quarterly dividends, and potential for property appreciation, Arrived makes a compelling case.

However, it’s not all smooth sailing. The platform has a limited selection of properties and is focused primarily on the U.S. market. Additionally, the fee structure isn’t explicitly laid out, so make sure you read the fine print carefully.

What’s the Big Deal with Real Estate Tokenization?

So, you’ve heard the term “real estate tokenization” thrown around, but what does it really mean?

At its core, real estate tokenization is the process of converting a tangible, physical asset—like a building—into a digital token on a blockchain.

Think of it as a digital transformation for the property market, making it more democratic, transparent, and downright exciting.

Breaking It Down

In traditional real estate, buying a property often involves a mountain of paperwork, middlemen, and, let’s face it, money.

Tokenization simplifies this by breaking down a property into digital shares, or “tokens,” each representing a fraction of the property’s value.

These tokens can be bought and sold on various platforms, making the whole process more streamlined.

- Affordable: Real estate tokenization lowers the entry barrier. You don’t need to buy an entire property; you can just buy a fraction of it. This makes it easier for more people to get into real estate investment.

- Accessible: With tokenization, you can invest in properties from around the world, all from the comfort of your home. No need to deal with international laws or currency exchange rates.

- Liquid: Traditional real estate is notoriously illiquid. Selling a property can take months or even years. Tokens can be traded much more quickly, offering a level of liquidity that’s hard to find in traditional real estate.

The Tech Behind It

The technology that makes this possible is blockchain. It’s the same tech that powers cryptocurrencies like Bitcoin and Ethereum. Blockchain ensures that all transactions are secure, transparent, and immutable. This means that once a transaction is recorded, it can’t be altered or deleted, providing a level of security and trust that’s crucial for something as significant as property investment.

Read more about how blockchain is revolutionizing various industries.

Why Should You Care?

You might be thinking, “Cool tech, but why should I care?” Well, there are several compelling reasons why real estate tokenization should be on your radar.

Diversification

In traditional real estate, diversifying your portfolio could mean a significant financial commitment.

With tokenization, you can invest in multiple properties without needing a fortune.

You could own a piece of a beachfront property in Miami, an apartment in Paris, and a commercial space in Tokyo, all without breaking the bank.

Transparency

One of the biggest advantages of using blockchain technology is transparency. Every transaction is recorded on a public ledger that anyone can verify.

This eliminates the need for trust in third parties and reduces the risk of fraud.

Ownership

In traditional real estate, your ownership is often recorded on a piece of paper that’s stored in some government office.

With tokenization, your ownership is recorded on a blockchain. This not only makes it more secure but also simplifies the process of transferring ownership.

The Criteria: How We Picked the Top 10

Choosing the right platform for your real estate token investment is crucial. But with so many options out there, how do you pick the best one? Here’s the criteria we used to compile our top 10 list.

User Experience

The platform should be easy to use, even for those who are new to real estate or blockchain. A complicated user interface can be a significant barrier to entry.

Security

Security is paramount when it comes to investments. The platform should use advanced security protocols to protect your data and your tokens.

Community Reviews

What are other investors saying about the platform? Community reviews can provide valuable insights into the platform’s reliability, customer service, and overall reputation.

Asset Quality

The quality of the properties available for investment is also a crucial factor. Look for platforms that offer a diverse range of high-quality assets.

Regulatory Compliance

Last but not least, the platform should comply with the relevant regulations. This ensures that your investment is legal and reduces the risk of potential legal issues down the line.

By considering these factors, you can make a more informed decision and choose a platform that suits your needs and investment goals.