Staking has become a popular way to earn passive income in the world of cryptocurrency.

With the emergence of DeFi (decentralized finance), staking has become even more accessible to the average user.

In this guide, we’ll cover everything you need to know about staking, including its definition, benefits, and how to get started with DeFi staking.

What is staking?

Staking is the process of holding cryptocurrency in a wallet and using it to support the operations of a blockchain network. In return for staking their cryptocurrency, users are rewarded with additional cryptocurrency.

How does staking work?

Staking works by using Proof of Stake (PoS) consensus mechanisms. PoS is a consensus mechanism that relies on users staking their cryptocurrency to validate transactions on the network. The more cryptocurrency a user stakes, the more likely they are to be selected to validate transactions.

Benefits of staking

a. Passive income

One of the main benefits of staking is passive income. Users can earn additional cryptocurrency by staking their cryptocurrency and participating in the validation of transactions on the network.

b. Security

Staking also helps to secure the network by encouraging users to hold onto their cryptocurrency and use it to support the operations of the network. This makes it more difficult for attackers to compromise the network.

c. Network participation

Staking also encourages network participation by incentivizing users to hold onto their cryptocurrency and use it to support the operations of the network.

Staking vs. mining

Staking is often compared to mining, as both involve participating in the validation of transactions on a blockchain network. However, staking is generally considered to be less resource-intensive and more environmentally friendly than mining.

How to stake with DeFi

a. Choosing a staking platform

The first step in staking with DeFi is to choose a staking platform. There are several DeFi staking platforms available, and users should choose one that is reputable and secure.

b. Setting up a wallet

The next step is to set up a wallet. Users should choose a wallet that is compatible with the staking platform they have chosen.

c. Staking your cryptocurrency

The final step is to stake your cryptocurrency. Users can do this by following the instructions provided by the staking platform. Once the cryptocurrency has been staked, users will begin earning rewards.

Examples of successful DeFi staking platforms

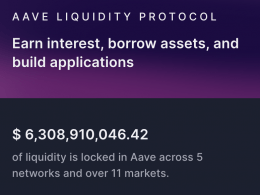

a. Aave

Aave is a DeFi staking platform that allows users to stake their cryptocurrency and earn rewards. Aave supports several cryptocurrencies, including Ethereum, Dai, and USDC.

b. Compound

Compound is a DeFi staking platform that allows users to lend and borrow cryptocurrency. Users can stake their cryptocurrency as collateral and earn rewards in the form of interest.

c. Uniswap

Uniswap is a decentralized exchange that allows users to trade cryptocurrency without the need for a central authority. Users can also stake their cryptocurrency on Uniswap and earn rewards.

Risks and limitations of staking

While staking can be a great way to earn passive income, there are also risks and limitations that users should be aware of. One of the main risks is market volatility, as the value of cryptocurrency can fluctuate rapidly. Additionally, staking may not be available for all cryptocurrencies, and users should be careful to choose reputable staking platforms.

Conclusion

Staking is a great way to earn passive income in the world of cryptocurrency. With the emergence of DeFi, staking has become even more accessible to the average user. By following the steps outlined in this guide, users can get started with DeFi staking and begin earning rewards.

Staking is the process of holding cryptocurrency in a wallet and using it to support the operations of a blockchain network.

Staking works by using Proof of Stake (PoS) consensus mechanisms.

The benefits of staking include passive income, security, and network participation.

Some examples of successful DeFi staking platforms include Aave, Compound, and Uniswap.

The risks of staking include market volatility and the potential for scams or fraud.