There’s a storm brewing in the Bitcoin network, and it’s putting miners on edge. With the introduction of inscriptions and the looming halving event, miners are walking a tightrope.

But what exactly are inscriptions, and how do they impact the Bitcoin ecosystem?

Let’s delve into the intricate dance between inscriptions, blockspace, and miner profitability!

Inscriptions: The New Blockspace Consumers

Introduced in February 2023, inscriptions have become significant consumers of Bitcoin blockspace.

They’re essentially the Bitcoin networks variation of NFTs.

These allow Bitcoin users to encode files into the witness portion of the transaction data structure, acting as a form of ‘packing filler.’

They fill the remaining space once higher-value monetary transfers are packed into blocks.

- First Wave: Dominated by images and files, users explored Bitcoin native NFTs through the Ordinal protocol.

- Second Wave: Dominated by text, with the emergence of BRC-20 tokens, such as the SATS token, which alone is responsible for at least 21M new UTXOs.

Inscriptions have led to an uptick in daily confirmed transaction counts, breaching 550k per day, and contributing to a rapidly expanding UTXO set, marking the largest rate of weekly increase in history.

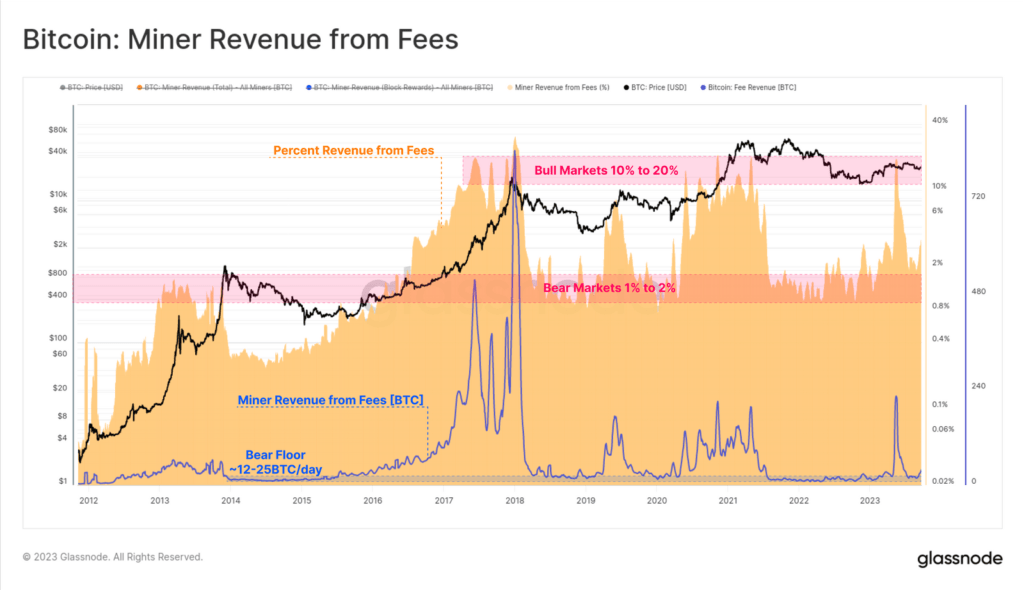

Impact on Miners: A Double-Edged Sword

While inscriptions have increased blockspace demand and fee revenue for miners, the competition is fiercer than ever.

The hashrate, representing the amount of computational power used to secure the network, has surged by 50% since February, driving the hashprice, the reward miners receive per unit of hashrate, to new all-time lows.

- Fee Revenue Increase: 216% from ~12 BTC/day to 38 BTC/day.

- Hashrate Increase: 50% since February.

- Hashprice: Miners earn just 2.26 BTC (~$60k) per Exahash.

The Looming Halving: A Ticking Time Bomb

The halving event, approximately 206 days away, is a pre-programmed reduction in the rewards miners receive for adding new blocks to the blockchain.

This event is likely to double the acquisition price of Bitcoin for miners, putting many under severe income stress unless BTC prices see a meaningful increase.

- Current Miner Acquisition Price: Around $24.3k.

- Post-Halving Acquisition Price: Estimated $30.2k.

Real-World Implications

The potential unprofitability of miners has far-reaching implications. It could lead to a decrease in network security, fluctuations in Bitcoin’s price, and a reshaping of the mining industry landscape.

Historical context shows varied outcomes of past halving events, making the upcoming months crucial for market watchers.

Miner Strategies and Market Reactions

Miners might adopt various strategies to remain profitable, such as seeking cheaper energy sources or upgrading equipment.

The developments could also trigger diverse market reactions, with investors closely monitoring the situation and adjusting their strategies accordingly.

Future Outlook

The Bitcoin mining landscape is poised for significant developments and challenges. The interplay between inscriptions, miner profitability, and market dynamics will shape the future of the industry.

With extreme miner competition in play and the halving event looming, the upcoming months are set to be a turbulent yet exciting time for the crypto community.

Conclusion: A Tense Balancing Act

Inscriptions have reshaped the Bitcoin network dynamics, adding both opportunities and challenges for miners.

With increased competition and the impending halving, miners are navigating turbulent waters.

The upcoming months will be crucial in determining whether the storm will lead to a miner’s treasure or leave them shipwrecked.