Ever wondered how blockchain could revolutionize traditional banking?

Chainlink’s presence at Sibos 2023 wasn’t just a cameo—it was a statement.

The company’s founder, Sergey Nazarov, sat down for an exclusive interview to discuss Chainlink’s role in the evolving landscape of digital assets, banking, and decentralized finance (DeFi).

Here’s a breakdown of the key takeaways.

This year’s Sibos conference proved to me that the desire and the demand from financial institutions to integrate blockchain technology is not only real, but here right now.

https://x.com/SergeyNazarov/status/1705288338989519079?s=20

Why Should You Care About Chainlink’s Influence in Banking?

The Buzz at Sibos 2023

Chainlink went big at Sibos 2023. They had a large booth and a team of over 10 representatives. The aim? To engage with banks, asset managers, and other stakeholders.

Key Reasons for Chainlink’s Presence:

- Engaging with banks and asset managers

- High demand for digital asset solutions

- Showcasing Chainlink’s technologies

Digital Asset Teams: The New Norm in Banks

Banks are no longer spectators; they’re players in the digital asset game. Many now have dedicated teams focused on digital assets.

This is a win-win for Chainlink and its Cross-Chain Interoperability Protocol (CCIP), which we’ll dive into shortly.

The Multi-Chain Reality

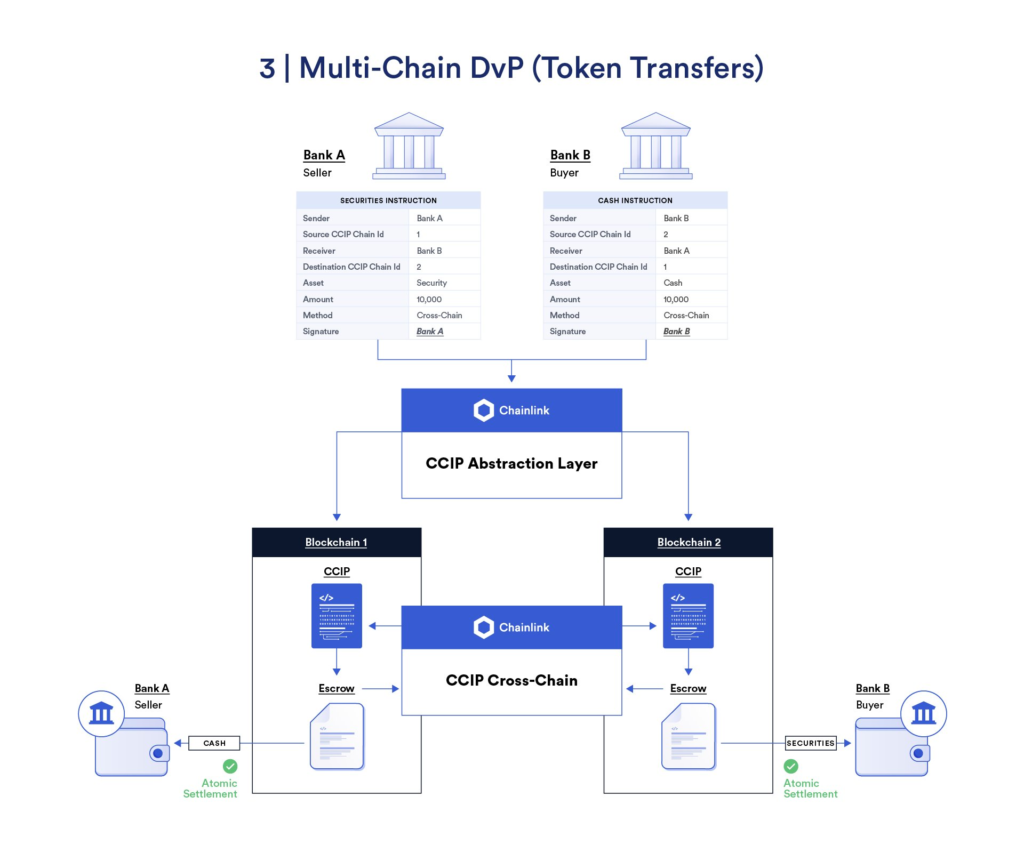

Banks have woken up to the reality that one chain won’t cut it. To transact with other banks and tap into new markets, they need to connect to multiple chains.

What Makes Chainlink’s CCIP a Game-Changer?

Collaborations with the Big Names

Chainlink’s CCIP technology is making waves. They’re collaborating with big names like Swift, DDCC, and Euroclear.

ANZ Bank is leading the charge in green and carbon credit assets.

For example, ANZ is exploring the tokenization of carbon credits, a move that could set a precedent in the industry.

The Birth and Significance of Reef Credit

A stablecoin called “Reef Credit” has emerged. It’s designed to facilitate the delivery versus payment of carbon offset assets related to Australia’s Barrier Reefs.

This is groundbreaking because it makes tokenizing such unique assets easier than ever.

Real-World Asset Tokenization: A Demo to Remember

Chainlink showcased a demo where one currency was converted into another, then into a stablecoin.

This was then transferred to another chain to facilitate a real-world asset transaction.

Banks are keen on this, and here’s why: it simplifies complex cross-border transactions.

How Will Real-World Assets Impact DeFi Markets?

The Benefits of Diversifying Collateral

| For Banks | For Public Chain DeFi Markets |

|---|---|

| Increased transactional throughput | Diversification away from crypto assets |

| More blockchain adoption | Reduced risk of market failure |

Chainlink: The Liquidity Enabler

Chainlink is not just a tech provider; it’s a liquidity enabler. What does that mean? In simple terms, liquidity is the ease with which an asset can be bought or sold.

Chainlink will play a crucial role in creating viable markets for bank-made assets in public chain DeFi markets.

Why is Liquidity a Big Deal?

Sergey Nazarov emphasized that without liquidity and a market, asset creation is pointless. CCIP allows for efficient connections between banks, eliminating the need for additional infrastructure.

What’s Driving the Demand for Interoperability?

The Simplicity Factor in Settlement Systems

Banks and key market players want simple, connected settlement systems.

This growing demand will eventually bring value to DeFi, especially when banks start incorporating stablecoins and real-world assets.

The Logic Behind Interoperability

Logic helps us predict outcomes. As legal barriers fall, the demand for interoperability will rise, benefiting both the banking and DeFi sectors.

What is Chainlink’s Vision for a Global Internet of Contracts?

Chainlink is working on CCIP as an interoperability standard.

This will connect the public chain DeFi world and the private chain Bank World, enabling efficient transactions between the two.

Imagine a world where all financial contracts, whether from a startup or a multinational bank, are interconnected. That’s the future Chainlink envisions.

Why Security Can’t Be an Afterthought

Security and reliability are non-negotiable for blockchain adoption. Chainlink understands this and is committed to building a secure and reliable system.

For context, a single security breach could result in losses amounting to millions, emphasizing the critical nature of this aspect.

As more bridges continue to get hacked, the importance of this defense-in-depth approach to security will become clearer and clearer.

https://twitter.com/SergeyNazarov/status/1706393452756218270

What’s Next? Chainlink’s Upcoming SmartCon Event

Chainlink is excited about its upcoming SmartCon event. Expect discussions on topics like interoperability standards, real-world asset tokenization, and much more.

Chainlink’s participation at Sibos 2023 marks a significant milestone in the journey towards a more interconnected financial ecosystem.

With its CCIP technology and collaborations with major banks, Chainlink is poised to be a key player in the integration of traditional finance and DeFi.

So, what’s the next big thing in finance? Keep an eye on Chainlink and stay tuned to Cryptogul for more updates.