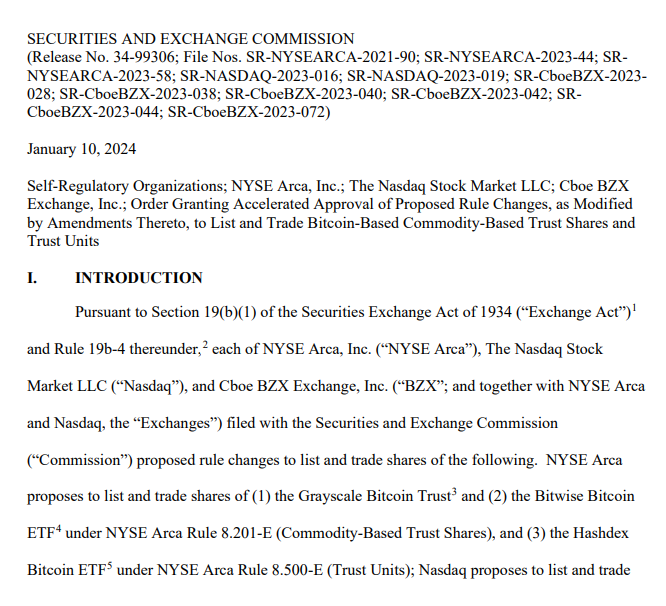

The U.S. Securities and Exchange Commission (SEC) has made a historic move by approving multiple Bitcoin Exchange-Traded Funds (ETFs), integrating cryptocurrency more firmly into the mainstream financial markets.

Official Document

These rule changes pertain to the listing and trading of Bitcoin-based commodity trust shares. Specifically, the amendments will allow for the trading of shares from the Grayscale Bitcoin Trust and the Bitwise Bitcoin ETF on NYSE Arca, as well as shares from the Hashdex Bitcoin ETF on Nasdaq.

These adjustments reflect a significant step in the integration of cryptocurrency-based products into mainstream financial markets, expanding investment options for individuals and institutions interested in digital currencies.

Competitive Fee Structure of Bitcoin ETFs

The approval by the SEC has led to a competitive adjustment of fee structures among issuers. The updated fee table, including promotional offers, is as follows:

| Issuer | Standard Fee | Promotional Offer |

|---|---|---|

| Bitwise | 0.20% | – |

| Ark/21Shares | 0.21% | – |

| Fidelity | 0.25% | – |

| VanEck | 0.25% | – |

| Franklin Templeton | 0.29% | – |

| BlackRock | 0.25% | 0.12% for the first 12 months or $5b in assets, whichever comes first |

| WisdomTree | 0.30% | – |

| Invesco/Galaxy | 0.39% | – |

| Valkyrie | 0.49% | – |

| Hashdex | 0.90% | – |

| Grayscale | 1.50% | – |

This table includes BlackRock’s updated fee of 0.25% and their promotional offer, detailed in a Blockworks article.

Bullish Impact on the Cryptocurrency Market

The approval of Bitcoin ETFs is expected to have a positive impact on the cryptocurrency market, as discussed in various financial news outlets like CoinDesk. These ETFs make investing in Bitcoin more accessible to a broader range of investors, potentially leading to increased demand and higher prices.

Potential Price Predictions

While it’s difficult to predict exact price movements, the market sentiment is generally bullish with the introduction of Bitcoin ETFs. The increased ease of investing in Bitcoin, as reported by sources like Yahoo Finance, could lead to a surge in its value, though investors should remain aware of the inherent volatility in the cryptocurrency market.

Stay Informed

For ongoing updates on Bitcoin ETFs and their impact on the market, ensure you follow us across all of our social platforms and stay up to date with our latest posts!