The world of decentralized finance (DeFi) and web3 has opened up new avenues for lending and borrowing. With traditional financial institutions, users must trust a centralized authority to manage their assets.

But in web3, the trust is placed in the technology itself.

In this article, we’ll break down the basics of web3 lending platforms and provide an example of a popular platform: AAVE.

By the end, you’ll have a solid understanding of what web3 lending platforms are, how they work, and how to evaluate them.

What are Web3 Lending Platforms?

Web3 lending platforms are decentralized platforms that enable lending and borrowing of digital assets. They work within the DeFi ecosystem, using smart contracts to automate the process.

Advantages of using web3 lending platforms include:

- No central authority controlling your assets

- Lower fees compared to traditional lending platforms

- More accessible to a wider range of users, regardless of location or credit score.

Types of Web3 Lending Platforms

There are three main types of web3 lending platforms: flash loans, collateralized loans, and uncollateralized loans.

- Flash loans are short-term loans that don’t require any collateral.

- Collateralized loans require borrowers to put up collateral in exchange for the loan.

- Uncollateralized loans are similar to flash loans, but with a longer repayment period.

Evaluating a Web3 Lending Platform

When choosing a web3 lending platform, there are several factors to consider:

- Security: The platform must have strong security measures in place to protect user assets.

- Transparency: The platform should be transparent about its operations and how it handles user assets.

- User experience: The platform should be user-friendly, with a smooth and intuitive interface.

- Liquidity: The platform should have sufficient liquidity to provide the loans users need.

- Reputation: The platform should have a strong reputation within the DeFi community.

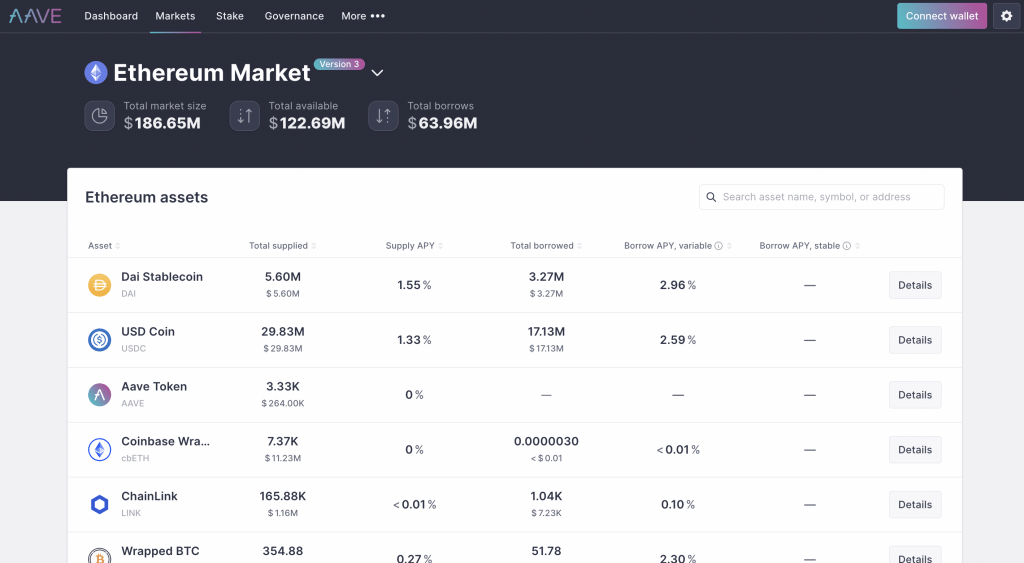

AAVE: An Example of a Web3 Lending Platform

AAVE is a popular web3 lending platform that offers a range of services, including flash loans, collateralized loans, and uncollateralized loans. It has a reputation for being secure, transparent, and user-friendly.

AAVE stands out from other web3 lending platforms by offering a unique feature called “Aave Protocol,” which enables users to earn interest on their deposits. The platform also offers a staking program, allowing users to earn rewards for participating in the network.

In conclusion, web3 lending platforms offer a new and exciting way for users to lend and borrow digital assets.

By understanding the types of platforms available, evaluating them based on key factors, and being aware of popular platforms like AAVE, users can make informed decisions about where to invest their assets.

So, dive in, do your research, and join the world of DeFi and web3 lending platforms today!